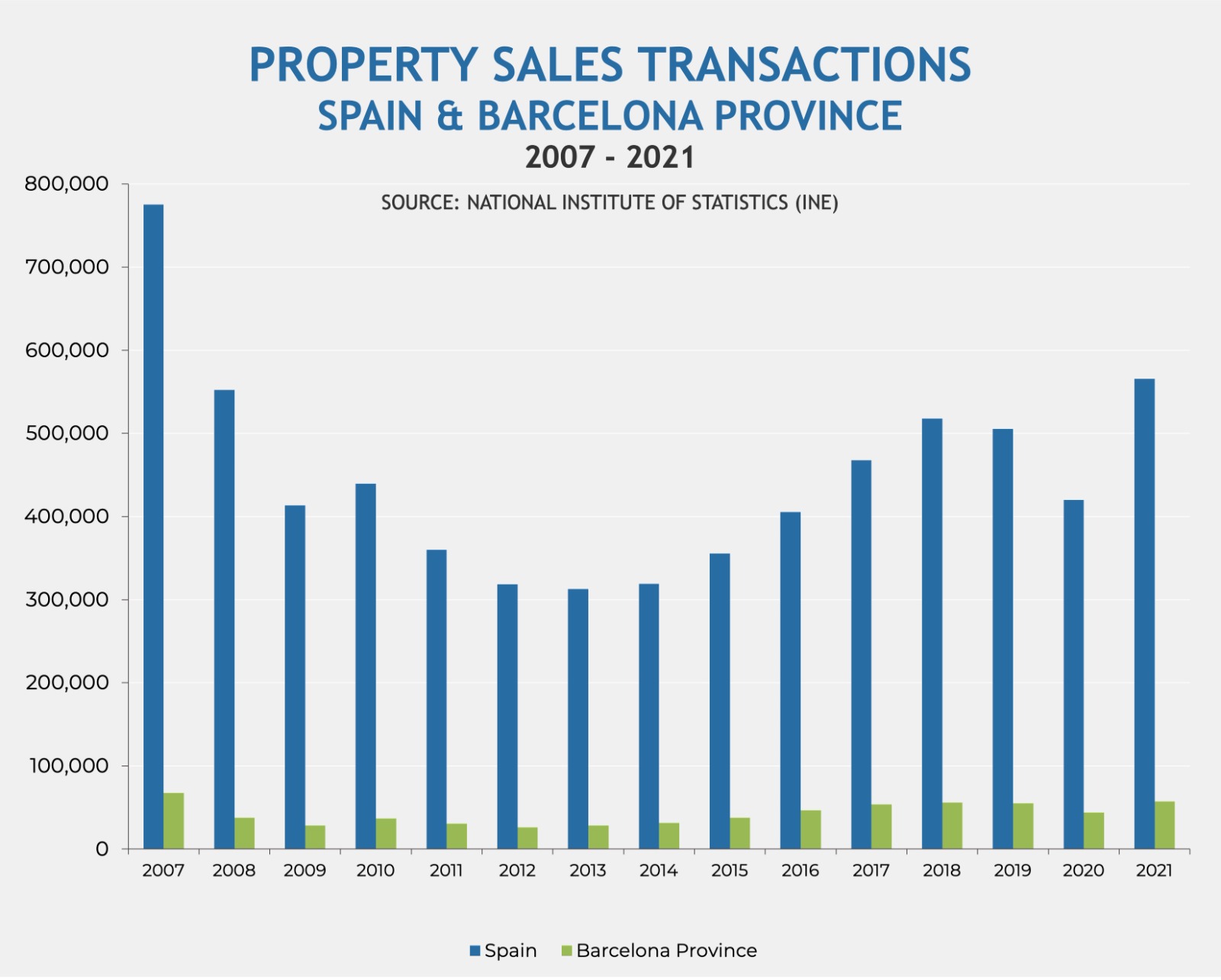

The Spanish property market made an excellent recovery in 2021 with property transaction figures across both the country as a whole and the province of Barcelona exceeding pre-pandemic levels. The increase in sales was down to a very slow 2020 and first half of 2021 which saw the sector practically come to a halt due to the Covid-19 pandemic.

The Spanish National Institute of Statistics (INE) registered 565,523 home sales in 2021, an increase of 34.6% on the previous year and the highest figure since 2007, when 775,300 homes were sold. When compared to pre-pandemic levels, the number of sales has increased by 11.9% since 2019.

Sales of new homes across the country increased by 37.7% when compared to the previous year, with INE registering a total of 115,038 transactions, the highest number since 2014. Looking at second hand housing, property transactions in 2021 rose by 33.8% when compared to 2020, with the highest number of transactions (450,485) ever recorded by INE.

Property sale transactions highest in 14 years

Property sales in the province of Barcelona have shown a similar trajectory, with INE registering 57,474 sales transactions in 2021, the highest figure since 2007 when 67,430 sales were registered. This shows an increase of 30.4% from 2020 to 2021.

The number of sales of new homes in the province of Barcelona in 2021 was up by 23.8% when compared to the sales of new homes in 2020, with INE registering the highest number of sales since 2011. When looking at used housing, the number of sales in 2021 increased by 31.9% compared to 2020 and returned to the pre-pandemic level of 2019.

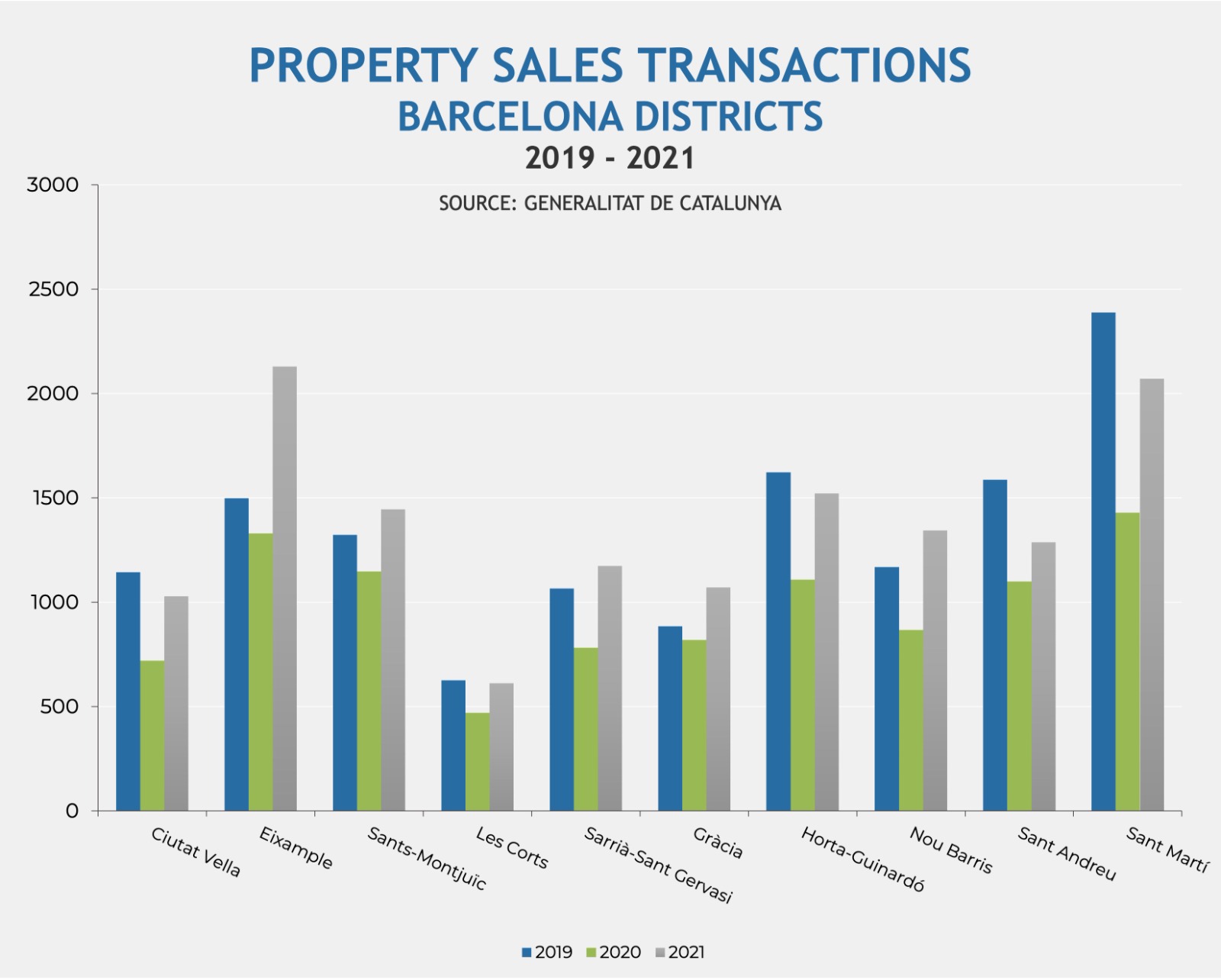

Barcelona City

The latest data from the Generalitat de Catalunya confirms positive trends. The number of sales in Barcelona city itself in 2021 increased by almost 40% when compared to the number of sales in 2020 and all of the city’s ten districts also registered increases. The highest rise was in the highly desirable and central district of Eixample where property sales transactions rose by almost 60%. This was followed by the upmarket area of Sarrià-Sant Gervasi where transactions rose by almost 50%.

– Ciutat Vella (Barcelona Old Town): 1,029 sales (42.72% increase)

– Eixample: 2,129 sales (59.95% increase)

– Sants-Montjuïc: 1,445 sales (25.98% increase)

– Les Corts: 612 sales (29.94% increase)

– Sarrià-Sant Gervasi: 1,174 sales (49.94% increase)

– Gràcia: 1,072 sales (30.89% increase)

– Horta-Guinardó: 1,522 sales (37.36% increase)

– Nou Barris: 1,345 sales (55.13% increase)

– Sant Andreu: 1,287 sales (17.00% increase)

– Sant Martí: 2,071 sales (44.83% increase)

Even though the number of transactions is rising significantly, average property prices in Barcelona city are still holding fairly steady and in some districts decreases are still being registered. At the end of February 2022, prices across the city as a whole showed an annual decrease of 1.4%, according to leading property portal Ideliasta, with the average price per square metre ending the month on €3,929. Four of the city’s ten districts registered an annual increase at the end of February: Eixample, Gràcia, Sant Martí and Sarrià-Sant Gervasi. It is uncertain as to how long it will be before prices start to rise to reflect the increase in sales transactions, but it does suggest that there are still many excellent opportunities to be found.

– Ciutat Vella (Barcelona Old Town): €3.988 per square metre (4.9 % decrease)

– Eixample: €4.594 per square metre (2.8 % increase)

– Sants-Montjuïc: €3.378 per square metre (1.5 % decrease)

– Les Corts: €4.923 per square metre (0.0 % change)

– Sarrià-Sant Gervasi: €5.240 per square metre (0.5 % increase)

– Gràcia: €4.278 per square metre (3.5 % increase)

– Horta Guinardó: €3.014 per square metre (1.8 % decrease)

– Nou Barris: €2.353 per square metre (5.5 % decrease)

– Sant Andreu: €3.073 per square metre (1.8 % decrease)

– Sant Martí: €3.559 per square metre (1.0 % increase)

Foreign buyers

Barcelona remains an extremely attractive option for foreign property buyers. Although the proportion of buyers from outside Spain acquiring property in the province of Barcelona in the last quarter of 2021 decreased very slightly when compared to the last quarter of 2020, it has in fact remained fairly steady in the last few years despite both Brexit and the Covid-19 pandemic: Q4 2018 (8.7%), Q4 2019 (9.5%), Q4 2020 (9.0%) and Q4 2021 (8.67%). This is a much higher proportion than in Madrid: Q4 2018 (5.8%), Q4 2019 (5.8%), Q4 2020 (4.9%) and Q4 2021 (4.53%).

“There was a virtual paralysis of transactions in Barcelona between March 2020 and June 2021 due to lockdowns and travel restrictions so a lot of the activity in the second half of 2021 was due to buyers playing catch-up. Once this accumulated demand is met, we expect to see a more stable period, and certainly no boom and bust as some forecasters have intimated. Prices have held out better than expected during the last two years of uncertainty and we expect to see steady price rises now that normality is returning. There are also excellent fixed rate mortgages available due to the historically low Euribor. These combining factors are creating a unique opportunity for buyers looking to invest in this beautiful city offering one of the best lifestyles in the world”, comments Francisco Nathurmal, founder and CEO of Bcn Advisors.

The new capital gains tax in Spain

The new capital gains tax in Spain

Top International Companies in Barcelona

Top International Companies in Barcelona

Best real estate agency in Barcelona: How to choose it?

Best real estate agency in Barcelona: How to choose it?