Are you looking for information about the housing price forecast in Barcelona in 2024? Find out if 2024 is the year to buy, sell or invest in real estate in Barcelona and Spain.

A year ago, some property experts were predicting that the Spanish market would see notable price drops. This turned out not to be the case In fact, the cost of buying a home in Spain actually increased by 8.2% (Idealista) last year.

Not surprisingly, the biggest price rises were seen in the country’s two largest cities – Madrid and Barcelona. Other areas of Spain that saw strong increases were the Mediterranean coastal regions and the Balearics, places which tend to attract foreign buyers and where interest continues to grow.

So what does 2024 have in store for the Barcelona property market? We look at different factors which could affect sales and prices in the Catalan capital with the expertise of Bcn Advisors CEO and founder Francisco Nathurmal.

Indulge in the epitome of refined living as you explore the curated collection of luxury apartments for sale in Barcelona, exclusively offered by Bcn Advisors.

Fast interest rate rises come to an end

When we talk about the forecast of house prices in Barcelona for 2024, we must undoubtedly talk about interest rates.

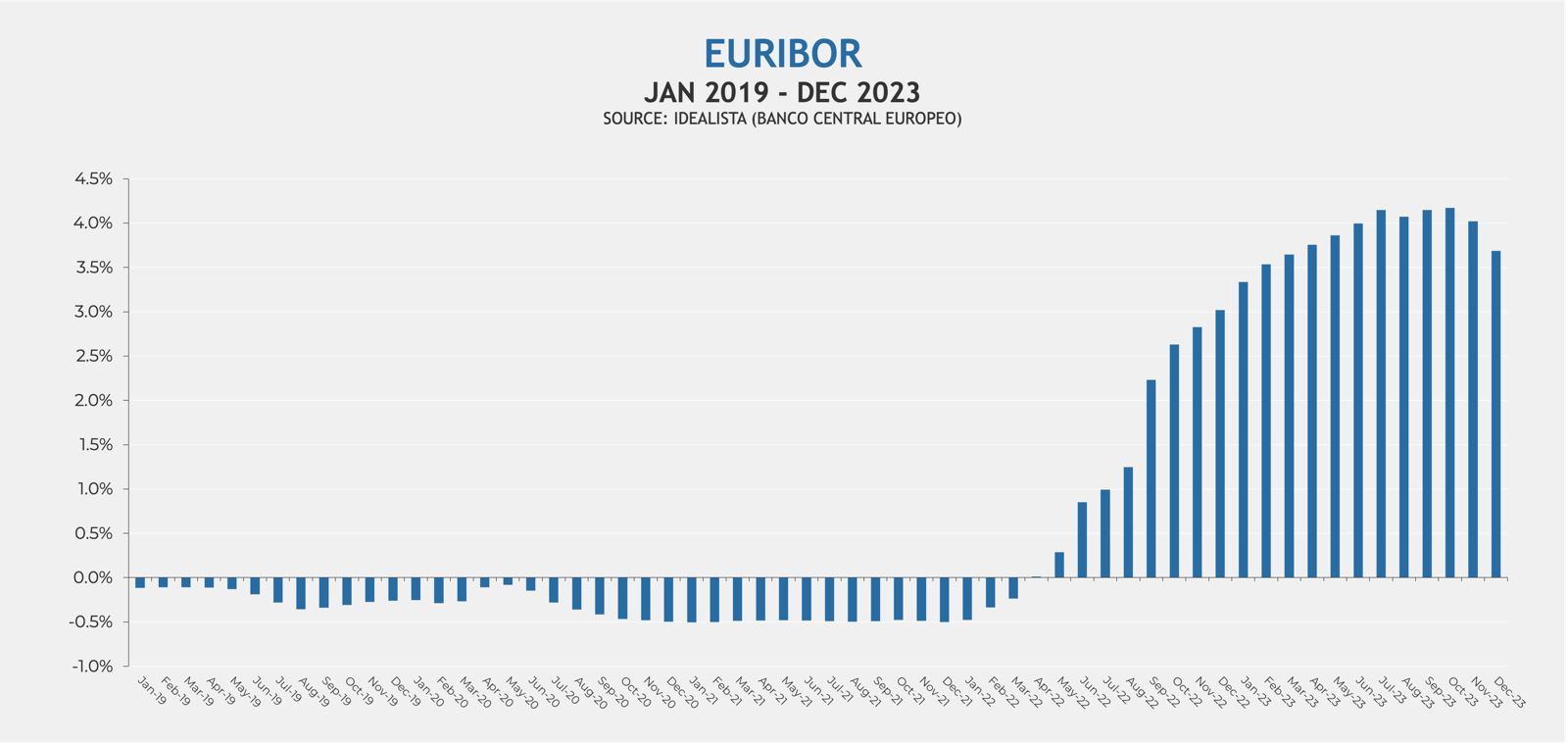

The interest rate hikes from 2022 to date were the sharpest in the lifespan of the Euro, increasing by more than 4.5% in barely 18 months, beating even that seen during Spain’s property boom years. Back then, between June 2005 and July 2008, interest rates rose by 3.25%.

They then fell to below zero for the first time ever in February 2016, staying that way for more than six years with an historic minimum of -0.504% in January 2021. The negative figures came to an end in April 2022 and rose to above 1% in August 2023 for the first time since 2015. Increases have since been notably sharp, more so than at any other time in the 24 year life of the euro.

These high interest rates inevitably have had an effect on mortgages which can slow down the property market. According to Nathurmal, however, the impact of high interest rates in Barcelona tends to be more pronounced in the lower priced segment (below 500,000€).

“Properties above €800,000 have shown resilience, partly because buyers in this segment often have stronger financial backing and are less dependent on financing. Tighter financing conditions might deter some domestic buyers and this scenario could lead to an increased market share of foreign buyers, who are often cash buyers or have access to financing outside of Spain”.

Foreign buyers

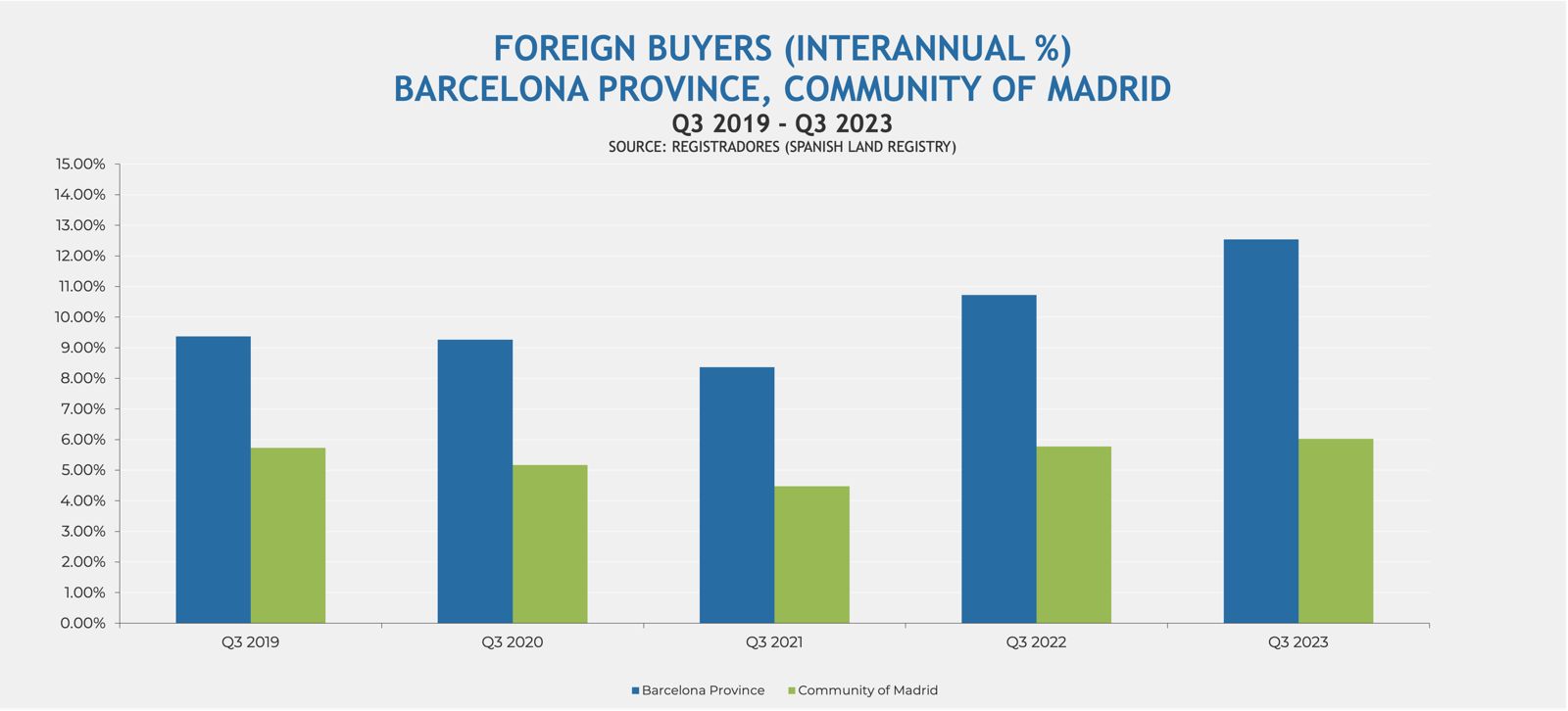

The most recent data available from the Spanish Land Registry (Registradores) shows that at the end of the third quarter of 2023 the percentage of foreign buyers in Barcelona province stood at 12.54% year-on-year. This is an increase on the similar previous period (from the end of the third quarter of 2021 to the end of the third quarter of 2022) when 10.72% of all buyers were from overseas.

The share of foreign buyers is significantly higher in Barcelona Province than in the Community of Madrid, where 6.02% of buyers were from overseas in the period from the beginning October 2022 to the end of September 2023. Latest research shows that the foreign population now makes up more than a quarter of the total of Barcelona’s population, a sign of just how popular the Catalan capital is not just as a tourist destination but as a permanent home.

Influential factors in housing price forecasts in Barcelona for 2024

1. Foreign investment

If foreign investors continue to put their money in properties in the catalan city (and therefore, they want to buy in a luxury real estate in Barcelona), this will have an effect on the entire market. The prestigious America’s Cup event, which will be held in Barcelona, is expected to attract high-net-worth individuals, potentially boosting the luxury property sector.

“The city’s reputation as a prime location for international events can drive demand, especially for mid-term and extended stay rentals” explains Nathurmal “However, due to the scarcity of listings and reduced new housing developments, property prices are likely to remain high, especially in sought-after areas. This scarcity, coupled with increased demand, is expected to keep prices stable or potentially drive them up.

In recent months we have received a lot of interest from different nationalities and in particular Americans who are looking to move out from the US, due to high costs of living, political social unrest and the decrease of quality of life”.

2. Urban infrastructure

Areas of Barcelona that are being developed or regenerated will likely become more sought-after. If an area becomes fashionable or improves its accessibility, prices can rise. “In recent years, neighbourhoods like Sant Martí have gone from an industrial hub to a tech hub with a vibrant startup community” comments Nathurmal.”Also neighbourhoods that offer a blend of cultural and historical appeal along with modern amenities are likely to be attractive.

The Eixample district, known for its upscale properties and architectural heritage, has always been appealing. However, investor focus might also turn towards emerging neighbourhoods that offer growth potential like the Sants – Montjuic District”.

3. Demographic trends: The increase in young professionals purchasing homes or the rise in single households may affect the demand for homes.

4. Housing policies: The availability pf new homes in Barcelona is restricted due to a number of factors, including limited land and restrictive housing policies. This limited supply is therefore likely to continue facing strong demand. The market is likely then to see demand outstripping supply, particularly in the new homes sector. Any new housing policies may take 2 to 3 years to take effect, however, meaning new homes may not appear for some time.

“Hopefully we might also see the new mayor of Barcelona, Jaume Collboni, be more friendly when it comes to the current housing policies that have been so restrictive for real estate developments in the city. This might be a very positive trend in 2024 for the Barcelona Real Estate Market” adds Nathurmal.

Other Key Property Trends in Barcelona in 2024

“Expect to see continued interest in sustainable and green properties as environmental concerns grow” says Nathurmal “Technology-driven amenities in housing could also see increased demand. Furthermore, the trend of remote working might influence property choices, with more demand for properties offering dedicated office spaces. Lastly, the market might experience a shift towards flexible housing solutions that cater to a transient population, especially around significant events like the America’s Cup and digital nomads.

We currently have a project that is currently being built in Barcelona which is a new development taking into account many of these upcoming trends and focusing on many technology–driven amenities, electric bicycle charging stations, low consumption heating and air-conditioning systems as well as a gym and healthy kitchen, located in the same building in order to promote wellbeing and health”.

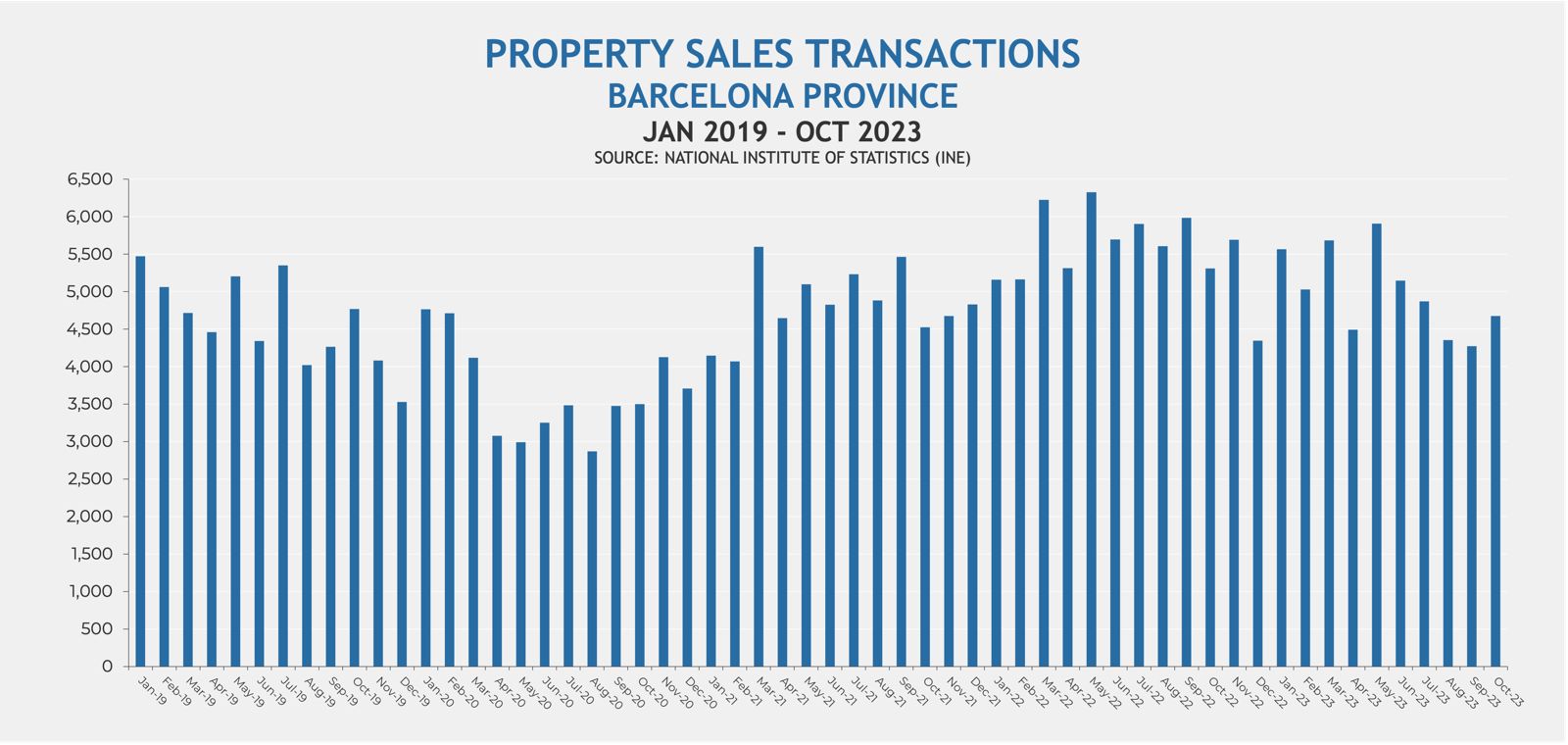

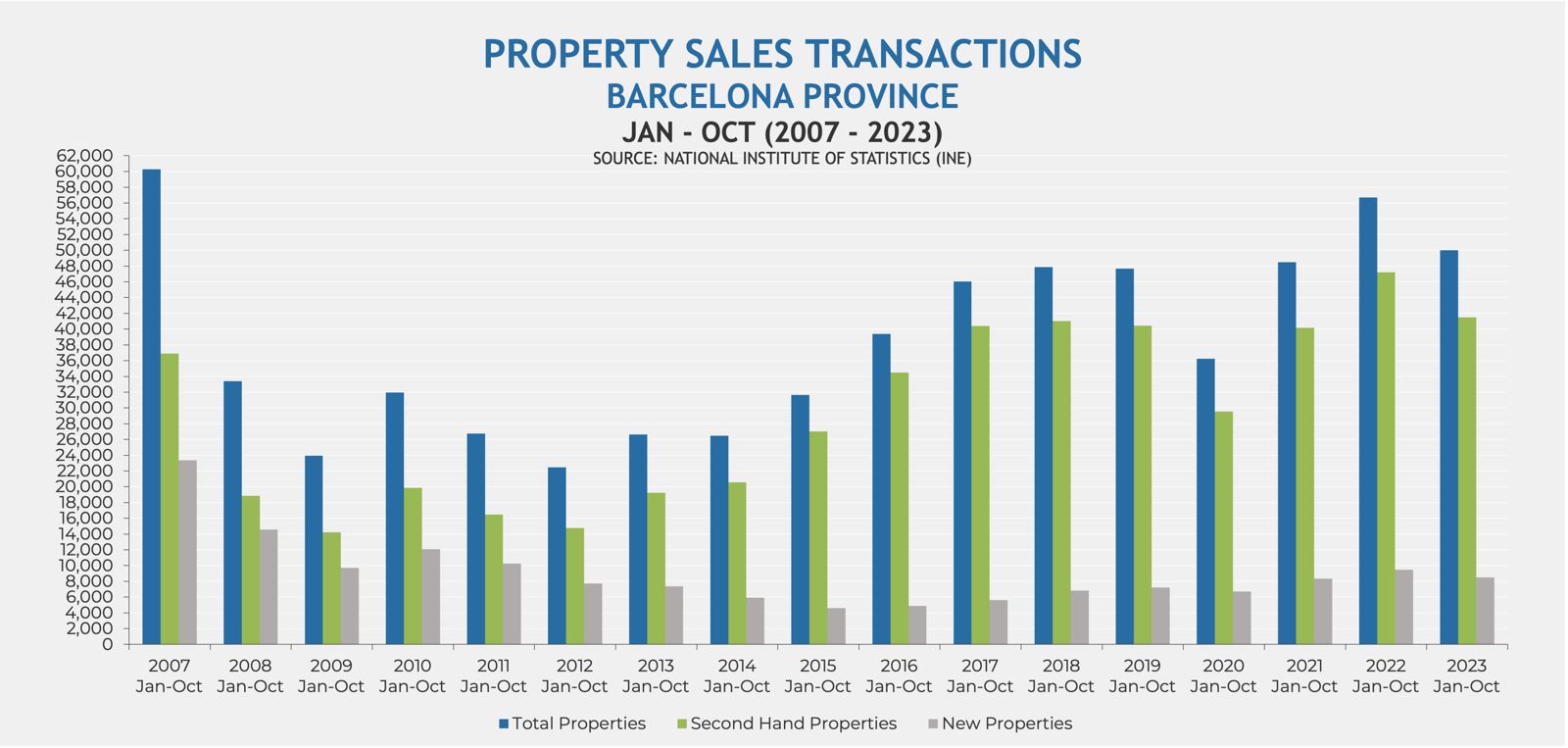

Barcelona property sales will continue to grow

The latest figures available from the Generalitat de Catalunya reveal a positive trajectory in property transactions within the city of Barcelona during the first three quarters of 2023. There was a 4.1% growth when compared to the same period in 2022, with 8,195 transactions registered from January to September 2023, up from 7,783 in the corresponding period of 2022.

Gràcia experienced the most significant surge, with sales increasing by a third, followed by Barcelona Old Town (23.6%), Nou Barris (19.2%) and Sant Andreu (15%). Only four of the city’s ten districts recorded decreases in property transactions.

– Eixample: 1,395 sales (2.35% increase)

– Sant Martí: 1,122 sales (6.81% decrease)

– Barcelona Old Town (Ciutat Vella): 770 sales (23.60% increase)

– Gràcia: 709 sales (33.27% increase)

– Sarrià-Sant Gervasi: 619 sales (17.02% decrease)

– Les Corts: 336 sales (10.64% decrease)

– Sants-Montjuïc: 978 sales (2.62% increase)

– Nou Barris: 844 sales (19.21% increase)

– Sant Andreu: 613 sales (15.01% increase)

– Horta-Guinardó: 735 sales (1.61% decrease)

Barcelona property prices rose steadily in 2023

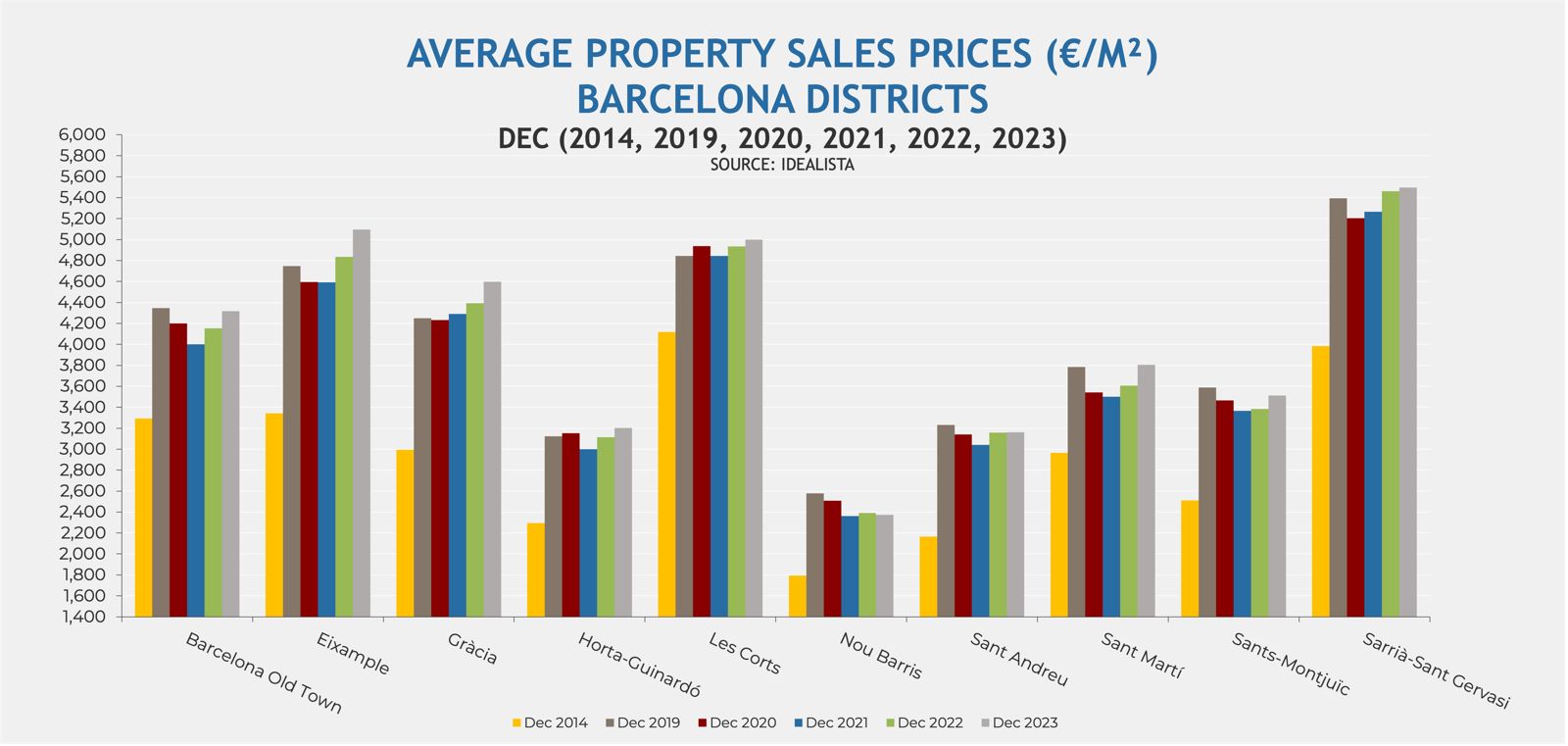

According to Idealista, the average property price across the city of Barcelona ended 2023 on €4,167 per square metre, an increase of 2.6% on the average price at the end 2022. Average prices at the end of the year rose in all but one of the city’s ten districts (Nou Barris), with the district of Sant Martí (home to Diagonal Mar, Glories and Diagonal Mar) registering the highest increase.

– Sant Martí: €3,804 per square metre (5.46% increase)

– Gràcia: €4,599 per square metre (4.71% increase)

– Eixample: €5,097 per square metre (4.30% increase)

– Barcelona Old Town: €4,316 per square metre (3.92% increase)

– Sants-Montjuïc: €3,513 per square metre (3.81% increase)

– Les Corts: €4,999 per square metre (1.28% increase)

– Horta-Guinardó: €3,202 per square metre (2.83% increase)

– Sarrià-Sant Gervasi: €5,498 per square metre (0.66% increase)

– Sant Andreu: €3,160 per square metre (0.06% increase)

– Nou Barris: €2,372 per square metre (0.79% decrease)

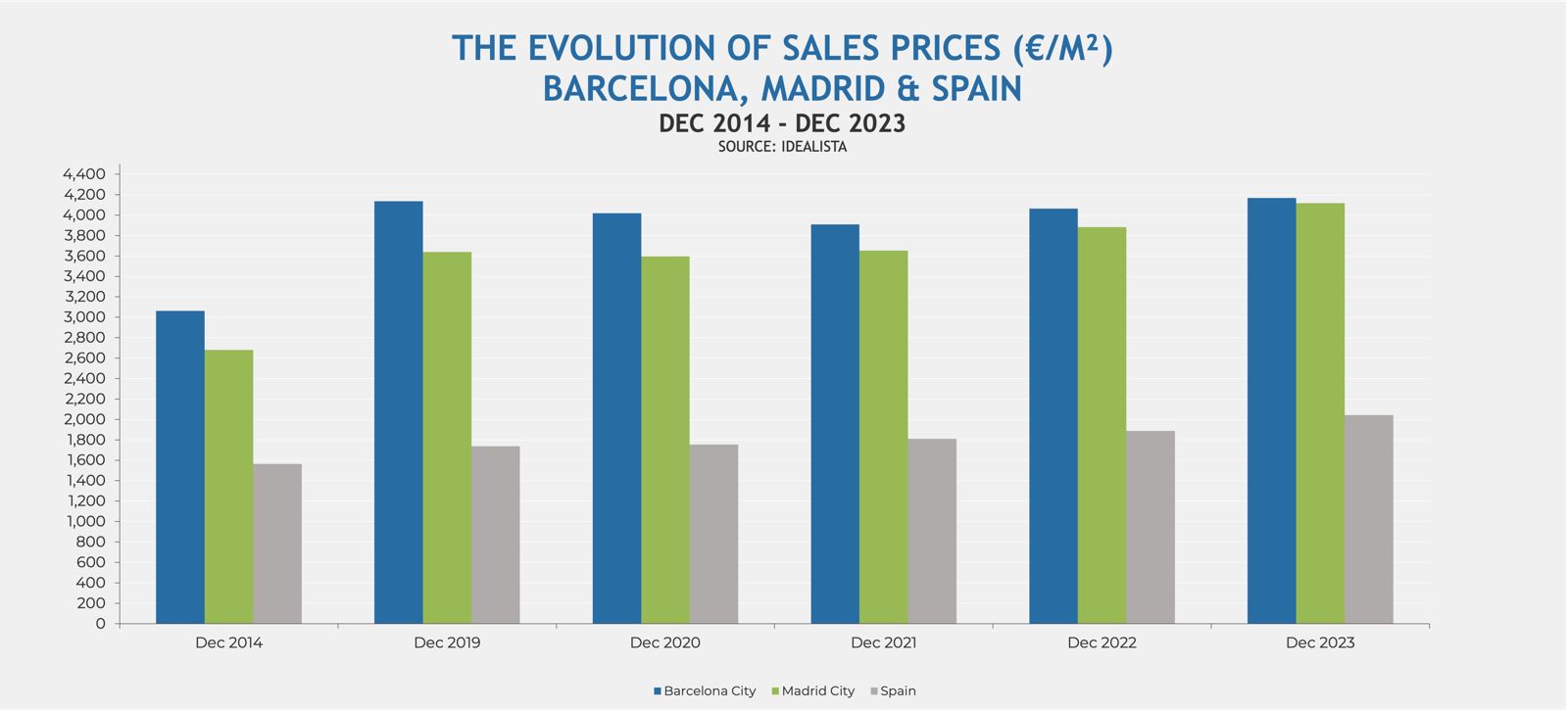

Although average prices in Madrid City are catching up with those in Barcelona City, they still remain slightly lower, with the average price in Madrid ending 2023 on €4,118 per square metre, an annual rise of 6.1% (whilst the average price in Barcelona City rose by 2.6% to €4,167 per square metre at the end of the year).

Barcelona Rental Prices

2023 saw the Spanish government introduce a new Housing Law to try to ensure there are more rental properties available for Spanish nationals. Most people agree that the law has caused more issues for tenants than it has resolved, creating a lack of supply and an increase in prices.

This is partly due to an increase in seasonal rentals which have less restrictions, making it even more difficult for families to access affordable housing.

Rental prices in all ten of the city’s districts registered an annual increase at the end of 2023. Across the city as a whole, average rental prices increased by 12%, ending the year on €20.5 per square metre.

– Barcelona Old Town: €23.8 per square metre (11.21% increase)

– Eixample: €21.9 per square metre (14.06% increase)

– Sant Martí: €21.1 per square metre (12.23% increase)

– Gràcia: €20.6 per square metre (19.08% increase)

– Les Corts: €18.8 per square metre (12.57% increase)

– Sarrià-Sant Gervasi: €20.4 per square metre (2.00% increase)

– Sant Andreu: €16.2 per square metre (18.25% increase)

– Sants-Montjuïc: €18.6 per square metre (16.25% increase)

– Nou Barris: €15.4 per square metre (14.93% increase)

– Horta-Guinardó: €16.1 per square metre (14.18% increase)

Evolution of the Barcelona real estate market: Q4 2024

Evolution of the Barcelona real estate market: Q4 2024

Barcelona property price forecast 2025

Barcelona property price forecast 2025

Evolution of the Barcelona real estate market: Q3 2024

Evolution of the Barcelona real estate market: Q3 2024