¿Are you looking for more information about mortgage rates in Spain? We explain you everything you must know in the following lines.

Spanish banks offer some of the most attractive packages in Europe for residents and also for non-residents. Mortgage rates have been stable and at historical lows for some time and banks have lowered the interest on fixed rate mortgages, so this is a great time to buy a property.

After a second year of major disruption due to the health crisis, the Spanish real estate market might have been on the verge of collapse, given the restrictions we all faced, particularly with regards to foreign buyers who were unable to travel.

Do you want to sell your house or apartment in Barcelona? Get it faster with our team of professionals. Click now on our page for more information:

Sell your apartment with Bcn Advisors

Looking at the latest statistics, however, it is clear that a much more positive scenario is beginning to emerge. Sales by both national and international buyers are currently steady and at the top end of the market prices have even increased in some areas. It is widely thought that during 2022 property prices will rise in line with economic growth and sales will also increase.

INE data on mortgages in 2022

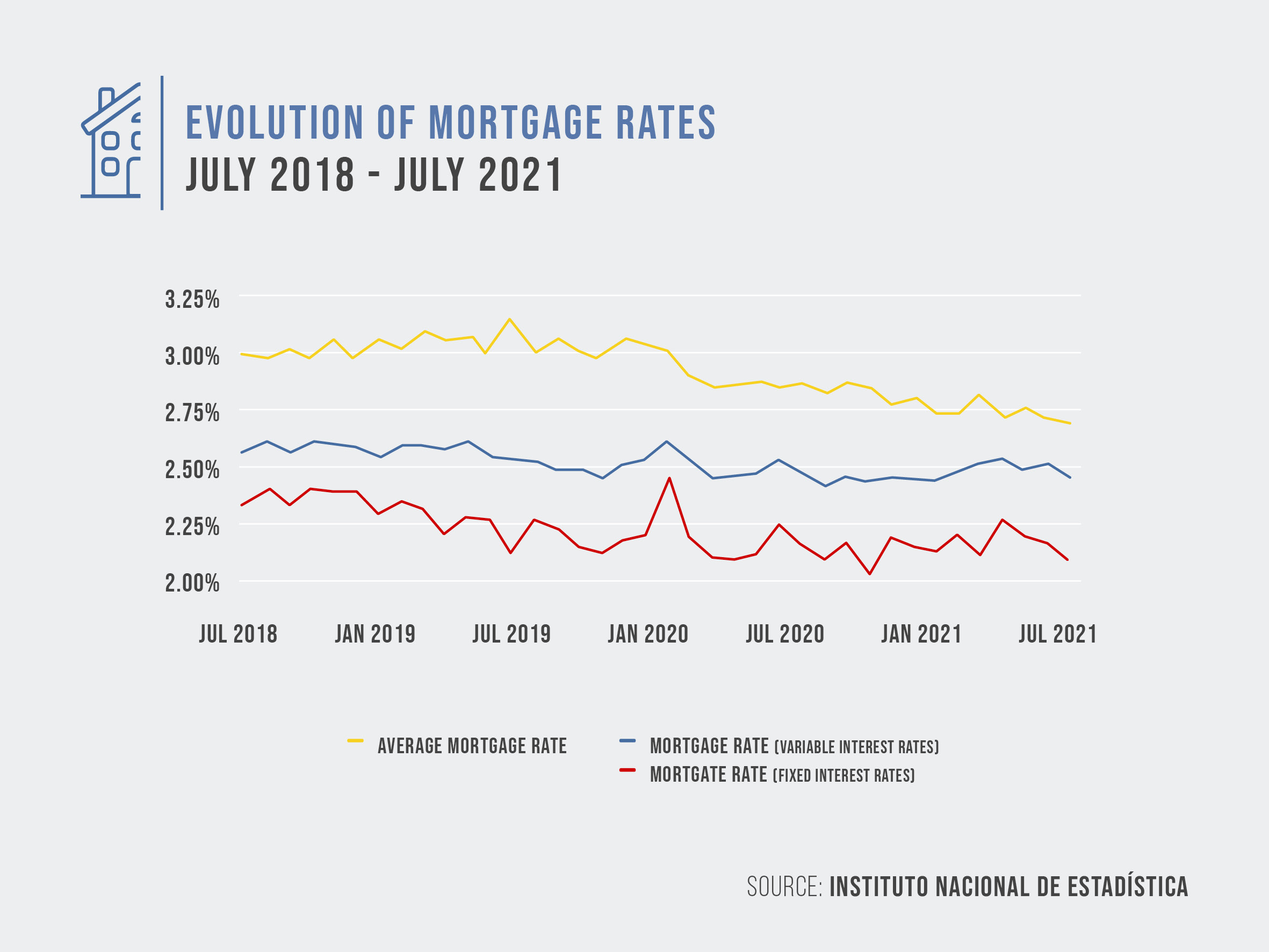

According to the latest statistics from INE, Spain’s National Institute of Statistics, the average mortgage in Spain has an interest rate of 2.11% for variable rate mortgages and 2.7% for fixed rate mortgages. Around a third of Spanish mortgages are variable, two thirds are fixed rate and the average duration is 24 years.

Evolution of mortgage interest rates (Source: INE)

Evolution of mortgage interest rates (Source: INE)

Attractive offers

Spanish banks offer some of the most attractive packages in Europe for residents and also for non-residents. Mortgage rates have been stable and at historical lows for some time in Spain (the Euribor has been in negative territory since 2015). Banks have lowered the interest on fixed rate mortgages (since they tend to earn more money than variable rate loans which depend on the Euribor) and are currently at their lowest level since 2006.

It is common to find fixed rates between 1% and 1.5% and variable rates between Euribor +1% and Euribor + 1.5% are also widely available. The Euribor reached its lowest ever level of -0.648% in December 2021 although it then rose back to its previous level at around -0.55%. According to Spain-based mortgage advisors Mortgage Direct, however, we could start to see mortgage rates increase – slowly – during 2022.

“If the European Central Bank (ECB) increases interest rates, then we will see the Euribor start to rise and there is the danger that cash-strapped households, already feeling the loss of purchasing power due to high inflation, would not be able to pay their mortgages each month,” explains Mortgage Direct’s Founding Partner Kevin Monger. “As a result, we may not see interest rate rises from the ECB or, if we do, they will be very low.”

Overseas buyers

Banks are also beginning to recognise the value of overseas buyers, who represent a significant proportion of homeowners in Spain, particularly in international cities such as Barcelona.

“Banks in Spain used to worry about non-residents defaulting on their mortgages, but nowadays there is very little difference in the rates offered to non-residents compared to Spanish nationals and fiscal residents,” comments Monger. “Regulation of the mortgage market in 2019 has meant that banks are no longer able to force add-on products onto borrowers, so many packages are with home insurance only, which buyers want anyway. We have a product at the moment where non-residents can borrow 70% for 20 years and the fixed rate option starts at 1.75% but this can be reduced to 1.15% by taking certain products. The resident package with the same lender is very similar and with the potential to go for a longer term of say 25 or 30 years.”

With a myriad of attractive home loans around, many homeowners may be tempted to re-mortgage, something that used to be fairly uncommon in Spain, but Monger says that this practice is now beginning to become more popular. “At least banks are more open to this now and due to law changes in recent years, the banks end up paying most of the costs. Often the banks prefer to do a cancellation and completely new mortgage rather than what is called a subrogation, where an existing mortgage is modified within certain restrictions and taken over by the new borrower,” explains Monger.

Interesting scenario

In recent months a few media are reporting that the current market could signal a housing bubble in many parts of Spain, but this is a claim dismissed by the majority of analysts who believe that steady price and sales growth throughout 2022 and beyond is a more likely scenario.

“We hear and read stories from real estate agencies, architects and others in the property market saying they are the busiest they have ever been. There seems to be less of the underlying issues that created the bubble that burst so spectacularly back in 2008, so we remain optimistic that it won’t happen again in 2022. No doubt the powers that be will want to control price inflation in the market as much as possible, so it promises to be an interesting 12 months ahead!” concludes Monger.

“In the last few years, low interest rates have meant more prospective home buyers entering the Spanish property market. Besides, from a seller’s perspective, it is worth considering selling during an environment when interest rates are low. After some time of going nowhere and doing nothing because of the pandemics, many households have managed to save money. With such low interest rates, it does not make sense to leave cash sitting in a bank. Never has there been a better time to get a mortgage”, says Francisco Nathurmal, founder and CEO of Bcn Advisors: the best luxury real estate in Barcelona.

Even though the consequences of the pandemic and its impact on the property sector are still not entirely clear – new Covid variants and inflation could also affect the market – what is known is that foreign buyers will be as key to the post-Covid recovery as they were after the 2008 crash. 2022 therefore looks be an opportune moment to capitalise on relatively competitive prices and continuing low interest rates.

The new capital gains tax in Spain

The new capital gains tax in Spain

Top International Companies in Barcelona

Top International Companies in Barcelona

Best real estate agency in Barcelona: How to choose it?

Best real estate agency in Barcelona: How to choose it?