Like all of us, the Spanish real estate sector has experienced a turbulent year in 2020. However, it has faced it with much more solid foundations than in the previous crisis of 2008, which foresees the next few years full of opportunities for buyers and sellers. Through the analysis of this year’s figures and the forecasts for the future, we review the situation of the Spanish real estate market.

First data on the real estate market trends

The health crisis during 2020 has severely impacted Spain’s economy and, subsequently, the country’s property sector. Some forecasters are predicting Spain’s economic output to fall by between 13% and 15% during 2020 and not to return to pre-crisis levels until the end of 2023.

The economic impact of the pandemic will significantly affect employment and with it the demand for property. Uncertainty about job prospects and household income will mean people could postpone decisions on long-term investments such as homebuying.

Despite this, the real estate sector in Spain is supported by a much stronger foundation than during the previous crisis of 2008. Prior to the Covid-19 pandemic, Spain’s households and companies were in a far healthier situation than they were 12 years ago. There was no oversupply of housing and banks have been much stricter on their criteria for lending.

Here we take a look at how the property market has performed during 2020, some of the emerging trends resulting from the pandemic and also what the real estate industry needs to do to ensure that the sector meets the changing demands of homebuyers in the ‘new normal’.

Spain’s Property Market 2020 figures

Home sales fell by 16.7% year-on-year in Q3 2020 and the fourth quarter is expected to show a similar trend with a gradual recovery in 2021. Given the drop in demand, prices will undergo a significant adjustment and some forecasters are predicting that by the end of 2021 they could be as much as 16% below their pre-Covid level in some areas.

There will be considerable differences in price drops, both geographical and in the type of housing, with most evidence pointing to tourist areas and second-hand properties suffering the biggest decline. The overall thinking is that central urban locations will be less affected as long as they have some kind of outside space as will new builds and high-end homes. Most experts believe that by the end of 2021, prices begin to rise again.

Real Estate Forecast 2020 by Idealista

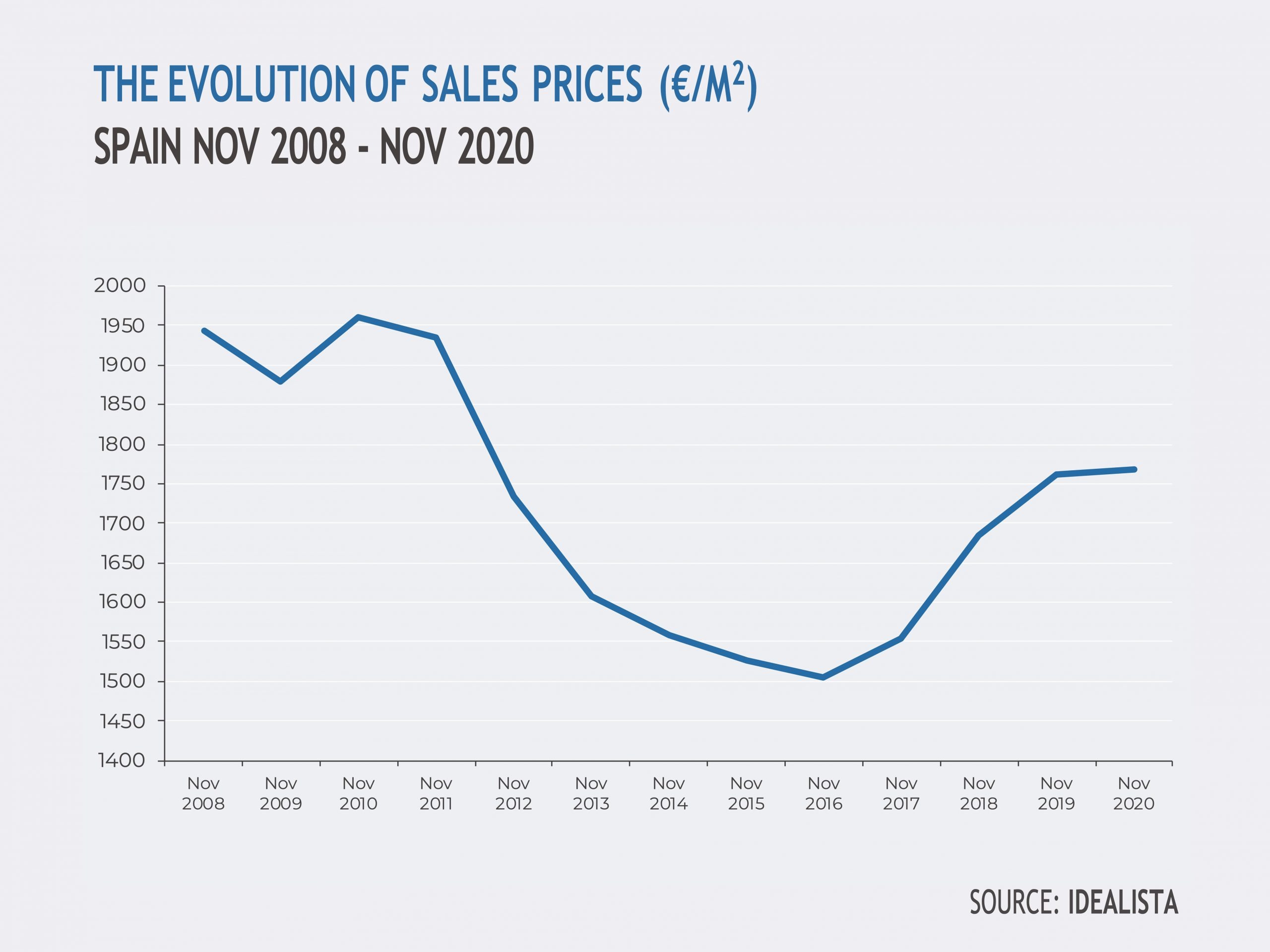

According to the property portal Idealista, average prices across Spain are up slightly year-on-year, by 0.45% to €1769 per square meter in November 2020. Comparing average prices to November 2014, the year of the last property turnaround, prices are up by 13.5% but are still 9% below the average price of November 2008, the year when prices peaked prior to the last ‘crisis’.

The proportion of foreign buyers dropped notably during 2020. In Q3 2020 11.4% of Spain’s buyers were foreign, compared to 12.6% in the same period in 2019.

If low interest rates continue, which is likely, this should help drive the property market forward in 2021. Lenders are currently offering packages with record low fixed term rates over 25 to 30 years, although it is expected that they’ll be more careful when lending to non-contracted workers.

There will be more opportunities for cash buyers and investors when the prices drop in 2021, who should be able see a return on their investment in the not too distant future.

Bcn Advisors’ analysis of real estate market trends

According to Francisco Nathurmal, the CEO of Bcn Advisors: “2021 will see fewer transactions, fewer buyers and fewer sellers. It is going to be a market of necessities. There will be sellers who choose to wait and there will be other sellers who will need to sell, providing an opportunity for buyers and investors in the market. The 3Ds – Death, Debt and Divorce – will trigger these sales in many cases.”

Buyer trends

The current health crisis has been a catalyst to change in different aspects of our lives, many of which relate to how and where we want to live. We have never spent so much time in our homes (and in our gardens if we are lucky enough to have one) so there will be greater demand for properties in city suburbs or close to green spaces. In urban areas, apartments with terraces or patio areas will be in greater demand.

As we are all spending more time in our home environments, more spacious and comfortable properties will also be highly sought-after. The home-office will also become a standard feature in properties as more people continue to work remotely. The same goes for the home gym. As we move into a more sustainable era, the demand for self-sufficient, modern homes will also grow.

Looking at the future buyer profile, investors looking for an opportunity will probably be younger, as they will not have been ‘burnt’ by previous boom and bust scenarios but, overall, buyers will be more cautious about purchasing.

Contact us to sell your home now with the best professional experts in the process of buying and selling real estate:

SELL MY HOUSE IN BARCELONA

There will be significantly fewer foreign buyers, particularly British buyers due to Brexit. British buyers currently make up 13% of foreign buyers in Spain, mainly on the Costa del Sol and Costa Blanca. As non-EU citizens, British property owners will only be able to spend 90 days in any EU country every 180 days which could deter some buyers and could also result in more homes owned by the British in Spain coming onto the market.

Owners of tourist apartments and/or second homes may be tempted to convert their properties into either long-term or mid-term rentals where there is more guaranteed income, or they may want to sell. More second homes outside the cities will be converted into primary residences as people choose to spend more time outside the city.

Real Estate Agencies

The economic and social changes over the next few years may be far-reaching and the real estate sector will need to adapt accordingly. As was the trend prior to the pandemic, agencies will be investing more in PropTech (digital transformation). That means the online customer experience will be crucial and simplicity will be key. A point that Bcn Advisors already takes into account in its listings of properties for sale or rent in Barcelona.

Buyers, particularly international buyers, will continue to view properties virtually, at least until travel restrictions are lifted, and even when they are, virtual 3D tours may become an increasingly popular way of filtering homes currently on the market. The in situ viewing will continue to be vital for the vast majority of homebuyers, however.

“Technology and innovation will keep the real estate industry on its toes in the post Covid era.”

“Increasingly, we are seeing new actors come onto the market, offering tools and solutions for real estate professionals. As a result, we will see some agencies disappear by the wayside. Those with advanced digital systems coupled with high levels of professionalism and customer services will be the winners in 2021 and beyond,” adds Francisco Nathurmal. “We must be able to turn the current challenges into opportunities but I firmly believe that Bricks and Mortar will continue to be regarded as one of the most stable investments in an unstable environment.”

Evolution of the Barcelona real estate market: Q4 2024

Evolution of the Barcelona real estate market: Q4 2024

Barcelona property price forecast 2025

Barcelona property price forecast 2025

Evolution of the Barcelona real estate market: Q3 2024

Evolution of the Barcelona real estate market: Q3 2024