After an extraordinary twelve months or so, there is much uncertainty as to what lies ahead for the Spanish property market. Covid-19 has inevitably had a major impact on the sector with prices falling in most areas midst decreasing demand and the expectation is that this will continue yet further until the economy starts to recover.

However, given that Spain’s GDP is predicted to grow up to 6% during 2021 according to the IMF, the hope is that demand will return once the current crisis is under control although it is unlikely that the market will recover to pre-Covid-19 levels until the middle of 2022. A lot will of course also depend on the successful roll-out of the vaccination programme, both at home and overseas.

Meanwhile, continued low interest rates combined with decreasing property prices are providing good investment opportunities for those with a solid financial status.

Sale prices decrease

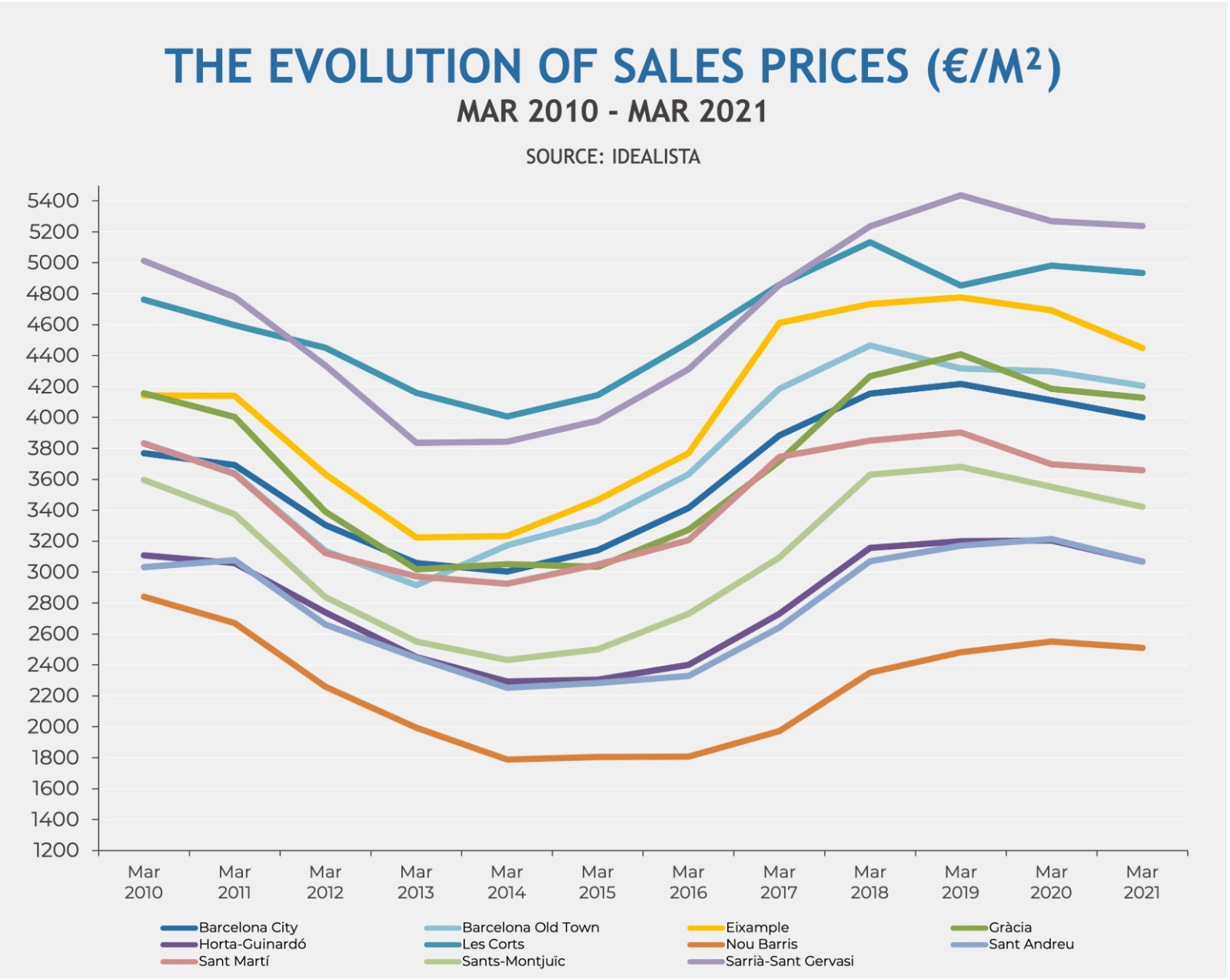

According to leading property portal Idealista (who base their data on asking prices), prices in Barcelona city had already started to show a slight annual decrease for the first time in five years in the middle of 2019. Year-on-year price drops have continued since then with the decreases becoming unsurprisingly more pronounced throughout 2020. At the end of March 2021, average property prices across the city as a whole registered an annual decrease of 2.7%, ending the first quarter of the year on €4,001 per square metre. They are, however, still 33.2% above the average prices in 2014.

Contact us to sell your house or flat in Barcelona with professional experts in the buying and selling process:

SELL MY FLAT IN BARCELONA

All of the city’s ten districts also registered annual price decreases at the end of March 2021, with the largest falls being in Eixample, Sant Andreu and Horta Guinardó, again indicating that there are investment opportunities to be found.

- – Eixample: €4,448 (5.2% decrease)

- – Sant Andreu: €3,068 (4.6% decrease)

- – Horta Guinardó: €3,069 (4.3% decrease)

- – Sants-Montjuïc: €3,422 (3.7% decrease)

- – Barcelona Old Town: €4,204 (2.2% decrease)

- – Nou Barris: €2, 510 (1.6% decrease)

- – Gràcia: €4,128 (1.4% decrease)

- – Les Corts: €4,933 (1% decrease)

- – Sant Martí: €3,660 (1% decrease)

- – Sarrià-Sant Gervasi: €5,239 (0.6% decrease)

The evolution of sales prices in Barcelona

Rental prices decrease

Rental prices have registered even larger decreases, as supply has outstripped demand over the last year causing prices to drop significantly. This is in part due to the lack of tourists and therefore landlords of short-term tourist rentals have been forced to put their properties on the open market. The exodus of people looking for properties more suitable for remote working in natural surroundings outside of the city has also contributed to this increased supply of rental properties.

Average rental prices across the city as a whole showed an annual decrease of 14.3% at the end of March 2021, ending the first quarter of the year on €14.5 per square metre, Rental prices in all of the city’s ten districts decreased, with the lowest decrease being 9.3% in Horta Guinardó. Barcelona Old Town, Sant Andreu and Eixample registered the highest decreases, with prices falling by 21.2%, 16.5% and 16.0% respectively at the end of March 2021.

- – Barcelona Old Town: €15.5 (21.2% decrease)

- – Sant Andreu: €12.2 (16.5% decrease)

- – Eixample: €14.7 (16.0% decrease)

- – Les Corts: €14.0 (13.3% decrease)

- – Sant Martí: €14.3 (12.4% decrease)

- – Sarrià-Sant Gervasi: €15.5 (12.0% decrease)

- – Sants-Montjuïc: €13.7 (11.8% decrease)

- – Gràcia: €14.1 (11.4% decrease)

- – Nou Barris: €11.9 (10.7% decrease)

- – Horta Guinardó: €12.3 (9.3% decrease)

Sales transactions

The effect of the pandemic on the property market is also reflected in the number of sales transactions. The latest data published by the Generalitat de Catalunya shows that the number of sales in 2020 decreased by 26.5% compared to 2019. Sales transactions in all ten districts registered decreases with the lowest falls occurring in the highly sought-after districts of Eixample and Gràcia, where the number of sales decreased by 11.2% and 7.5% respectively.

- – Sant Martí: (40.1% decrease)

- – Barcelona Old Town (37.0% decrease)

- – Horta Guinardó: (31.7% decrease)

- – Sant Andreu (30.7% decrease)

- – Sarrià-Sant Gervasi: (26.6% decrease)

- – Nou Barris: (25.8% decrease)

- – Les Corts: (24.8% decrease)

- – Sants-Montjuïc: (13.3% decrease)

- – Eixample: (11.2% decrease)

- – Gràcia: (7.5% decrease)

Once travel restrictions are lifted, international buyers will be keen return to the city, looking for opportunities or a change of lifestyle.

“Barcelona will always remain a popular location for those looking to invest or live and we are confident that once the current pandemic is under control, property buyers will return and prices will start to rise again,” comments Francisco Nathurmal, CEO and founder of Bcn Advisors.

Evolution of the Barcelona real estate market: Q4 2024

Evolution of the Barcelona real estate market: Q4 2024

Barcelona property price forecast 2025

Barcelona property price forecast 2025

Evolution of the Barcelona real estate market: Q3 2024

Evolution of the Barcelona real estate market: Q3 2024